As your business expands, so do your sales tax obligations. Businesses of all sizes – from global companies to domestic businesses – must navigate the complex and challenging world of sales and use tax, marked by continuously evolving laws and regulations. Tax compliance is further complicated by a growing shift to eCommerce, the economic nexus rule, and a broad range of sales tax rates and jurisdictions. Manually handling sales and use tax compliance can be tedious and cause errors, which can put your business at risk of costly audits and penalties.

To ensure accurate tax calculations, remittance, exemption certificate management, and filing, businesses should implement a sales tax software that can integrate with their ERP system. This way, your business can automate processes and reduce the overall burden of sales and use tax compliance.

In this blog post, we’ll cover the challenges associated with sales and use tax compliance as well as provide software solutions to simplify the process.

Challenges with Sales Tax Compliance

Economic nexus & varying state thresholds:

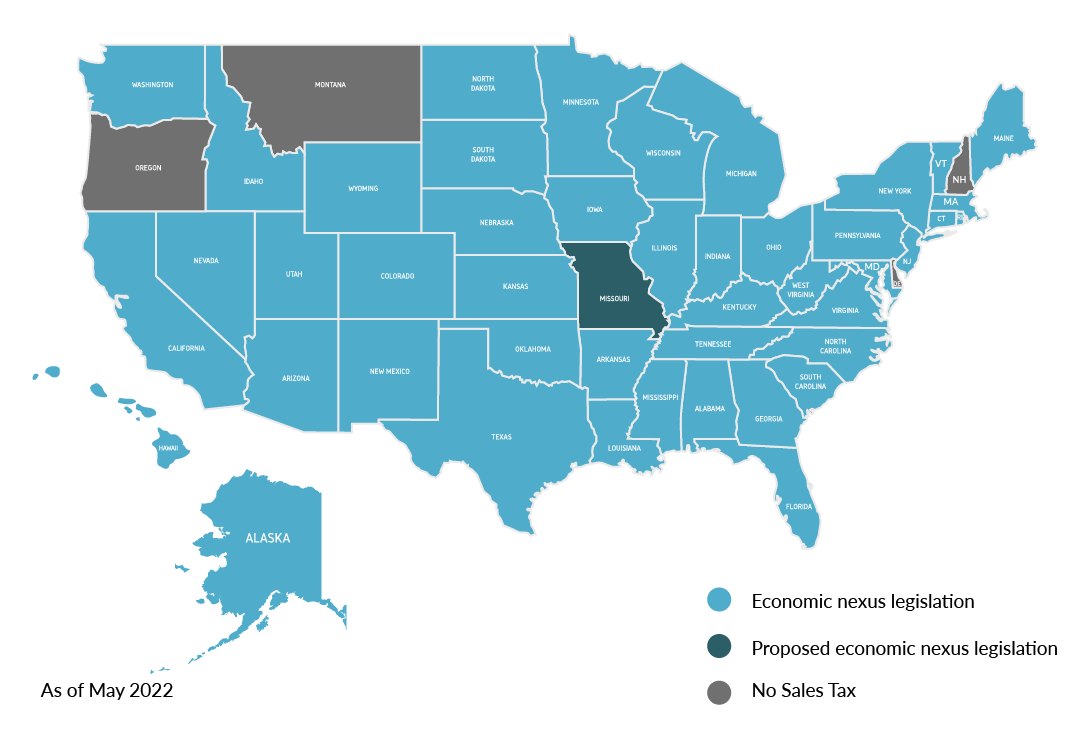

Following the Supreme Court’s 2018 decision in South Dakota v. Wayfair, almost every U.S. state issued economic nexus rules. The decision allowed states the authority to require that businesses collect and remit sales tax even if they do not have a physical presence in the state, thereby expanding the tax obligations of remote sellers.

A state determines its economic nexus threshold based on a business’ sales revenue and/or transaction volume in the state. Since these thresholds are not uniform across states, businesses face the complex challenge of staying up to date on nearly 50 different thresholds, list of included and excluded transactions, and diverse sales tax registration requirements.

Besides economic nexus, sales tax obligations, in some cases, can also be triggered by physical location in a state, remote workers, and affiliate relationships, among other factors.

As businesses grow and scale their geographic reach, there is additional strain on staff and resources to track sales tax nexus and thresholds, ultimately making tax collection and filing efforts more cumbersome. Further, an error or delay in registering with a state for sales tax purposes or failure to identify a nexus can expose a business to costly audits and penalties.

Multiple sales tax rates and changing regulations:

The United States has more than 11,000 sales tax jurisdictions, with diverse rates. For instance, as of July 1, 2021, the sales tax rate in Massachusetts was 6.25% whereas the rate in Georgia was 4%. Sales tax rates are also influenced by factors such as product or service type.

Due to changing budgetary conditions and other factors, states constantly make changes to their sales tax rates and regulations. So, businesses may find themselves struggling to manually keep track of diverse and shifting rates, jurisdictions, and regulations to avoid miscalculations and potential audits or penalties.

Managing sales tax exemption certificates:

Businesses are responsible for managing, validating, and documenting exemption certificates that are displayed by tax-exempt customers or those making tax-exempt purchases. In the event of an audit, the burden to justify a sales tax exemption is placed on the business. So, businesses must ensure customers provide adequate and up-to-date documentation to support an exemption as well as check for proper application of certificates to corresponding sales. This makes managing exemption certificates a challenging and time-consuming task for businesses.

Streamline & Automate Compliance with Sales Tax Software

The ever-evolving sales and use tax landscape can be challenging for businesses. Monitoring multiple rates, sales tax nexus, and new regulations along with ensuring accurate tax calculations, remittance, and timely filing – all while simultaneously focusing on growth – can be a monumental task for any business. Manually managing tax compliance and documentation is bound to introduce gaps or errors. To simplify compliance, businesses should implement software solutions that help automate complex and labor-intensive sales and use tax processes.

GraVoc’s strategic partner, Sovos, provides businesses with end-to-end tax compliance solutions to reduce errors, minimize audit risk, and keep pace with regulatory changes. Drawing from our 28 years of software and integration expertise, we collaborated with Sovos to design an adapter that seamlessly integrates the Sovos sales tax software solutions with customers’ Microsoft Dynamics 365 Finance and Operations ERP systems.

The simple sales tax software-ERP integration has proven benefits, including helping your business accurately track transactions and associated rates or exemption types as per jurisdiction, product or service taxability, customer taxability, and more. Your business can leverage this solution to minimize the manual burden of sales tax compliance on staff as well as ensure accurate taxation and filing.

The Sovos suite of Tax Compliance Solutions include:

Global Tax Determination

The solution provides automated, accurate sales tax rates and rule updates across the U.S. for state and local jurisdictions for all sales and purchases, and VAT and GST for more than 185 countries. The Sovos regulatory team tracks changes and updates Global Tax Determination content twice monthly to ensure your business has the most up-to-date information.

CertManager

Filing Solutions & Services

By utilizing the power of Sovos and Microsoft, businesses have a complete sales tax solution that will significantly reduce audit risk, streamline the tax compliance process, and help organizations keep up to date with regulatory changes.

Want to Integrate Sovos’ Tax Solutions with your Microsoft Dynamics 365 Finance & Operations System?

Click below to learn more about Sovos’ suite of tax compliance solutions and how you can integrate these solutions with your existing Microsoft Dynamics 365 Finance & Operations ERP system!

Related articles

[Webinar] How Hackers Think: A Behind-the-Scenes Look at Penetration Testing

Learn about the importance of penetration testing, different real-world attack scenarios, and how AI is impacting cybersecurity. Register now!

GraVoc Named to Accounting Today 2025 VAR 100 List

GraVoc has been named in the 2025 VAR 100 list by Accounting Today. We’re proud to be recognized for our growth as a Microsoft Partner!

Unlocking eCommerce Success: Explore GraVoc’s New Shopify Services

GraVoc is now a certified Shopify Partner! We design & develop custom Shopify websites to help businesses launch or grow their eCommerce presence.

![[Webinar] How Hackers Think: A Behind-the-Scenes Look at Penetration Testing](https://www.gravoc.com/wp-content/uploads/2025/07/Pentesting-webinar-400x200.png)